2024 Roth Ira Contribution Limits Chart – Use the table below to calculate your reduced contribution limit for 2024 based on the IRS’s announcement of 2024 changes to retirement-related items. Yes. You can contribute to a Roth IRA or . As mentioned earlier, Roth IRAs do not give you a tax break on the money you put in. Because of this, the IRS won’t tax or penalize you for removing your principal contributions prior to age 59 1/2. .

2024 Roth Ira Contribution Limits Chart

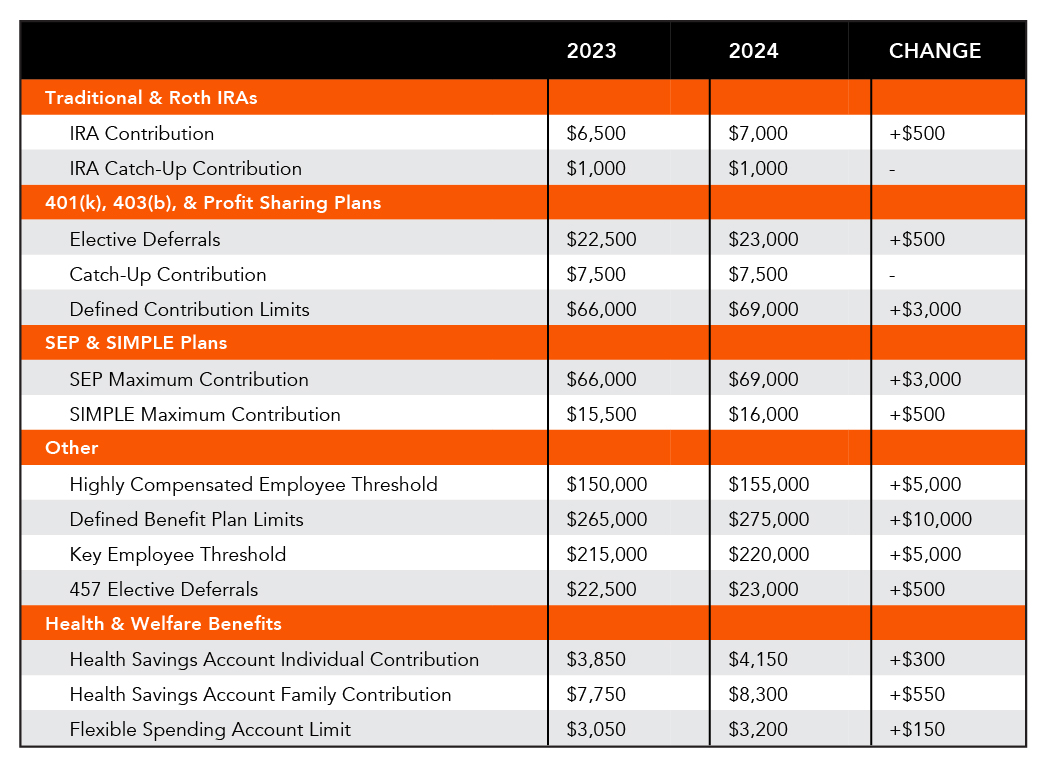

Source : www.theentrustgroup.comIRA Contribution Limits in 2024 Meld Financial

Source : meldfinancial.comEverything You Need To Know About Roth IRAs

Source : www.aarp.orgHere’s the Latest 401k, IRA and Other Contribution Limits for 2024

Source : theneighborhoodfinanceguy.comIRA Contribution Eligibility Flow Chart — Ascensus

Source : thelink.ascensus.comThe Best Order of Operations For Saving For Retirement

Source : thecollegeinvestor.comHistorical IRA Limit: Contribution Limit from 1974 to 2023 DQYDJ

Source : dqydj.comPlan Sponsor Update – 2024 Retirement & Employee Benefit Plan

Source : www.midlandsb.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comHistorical Roth IRA Contribution Limits Since The Beginning

Source : www.financialsamurai.com2024 Roth Ira Contribution Limits Chart IRS Unveils Increased 2024 IRA Contribution Limits: Suze Orman, a well-known financial advisor and author, is a strong advocate for Roth retirement accounts, including Roth 401 (k)s and Roth IRAs. According to Orman, these accounts provide substantial . A Roth IRA can be an incredibly powerful tool for your retirement. Key benefits it can bring you include: Once in your Roth IRA, your money can grow tax free for the rest of your life. .

]]>